- CryptoAI Signals

- Posts

- Best Cryptocurrency Tokens for Economic Downturns: Comprehensive Analysis vs Gold

Best Cryptocurrency Tokens for Economic Downturns: Comprehensive Analysis vs Gold

Top crypto picks for crises: stablecoins, Bitcoin, and gold tokens

Based on extensive historical data analysis from 2020-2024, this report evaluates the effectiveness of cryptocurrency tokens as safe haven assets during economic uncertainty, with particular focus on their correlation with traditional safe havens like gold12. The analysis reveals that while no cryptocurrency fully matches gold's safe haven characteristics, certain digital assets demonstrate superior crisis resilience and value preservation properties34.

Table of Contents

Best Cryptocurrency Tokens for Economic Downturns: Comprehensive Analysis vs Gold

Based on extensive historical data analysis from 2020-2024, this report evaluates the effectiveness of cryptocurrency tokens as safe haven assets during economic uncertainty, with particular focus on their correlation with traditional safe havens like gold12. The analysis reveals that while no cryptocurrency fully matches gold's safe haven characteristics, certain digital assets demonstrate superior crisis resilience and value preservation properties34.

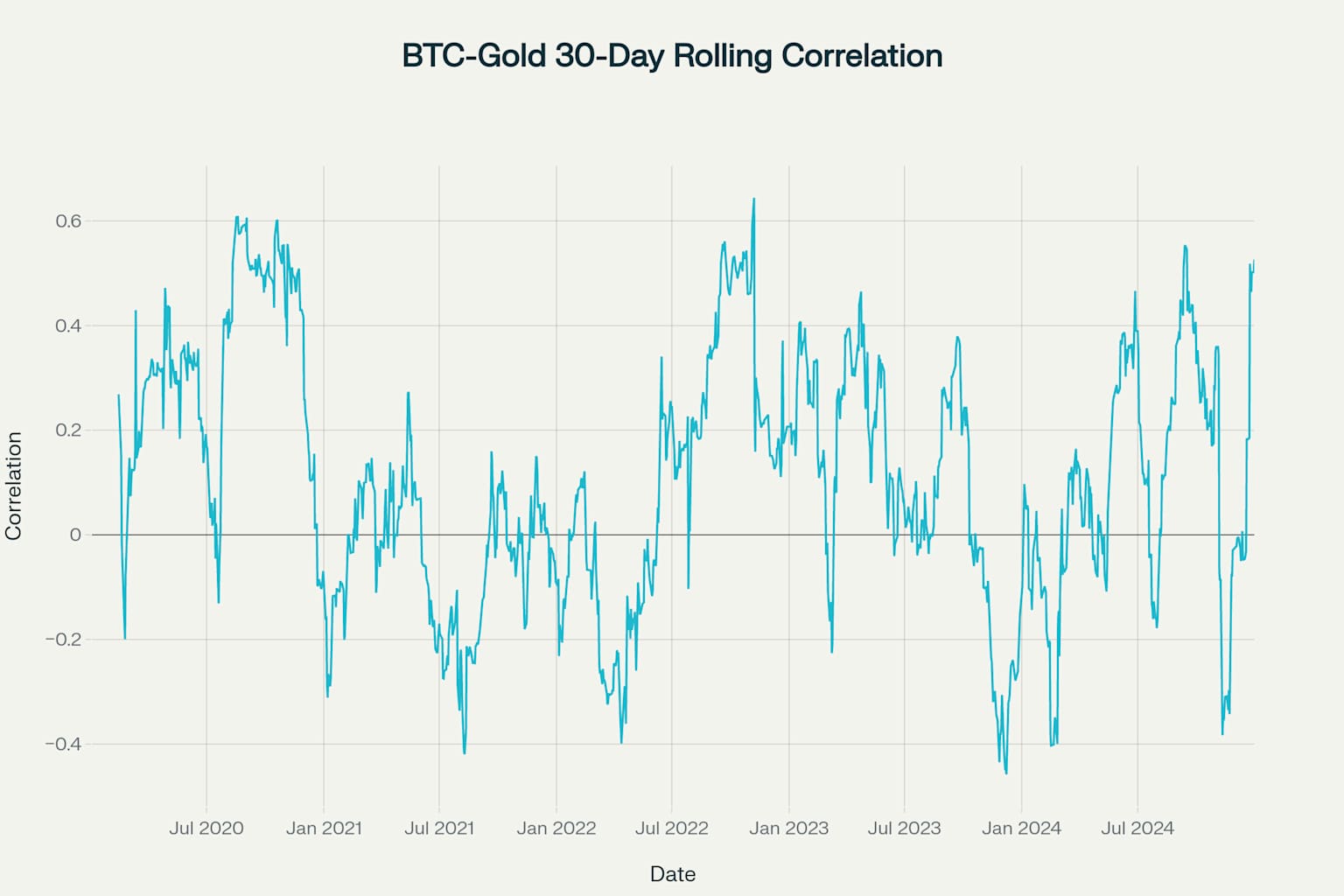

Historical Correlation Analysis: Bitcoin vs Traditional Assets

The correlation analysis between Bitcoin and gold reveals a complex relationship that has evolved significantly over the 2020-2024 period56. During the full analysis period, Bitcoin maintained a relatively low correlation of 0.128 with gold, suggesting some degree of independence from traditional safe haven movements7. However, this relationship strengthened considerably during crisis periods, with the Bitcoin-Gold correlation reaching 0.279 during the COVID-19 market crash of February-April 202048.

Bitcoin-Gold Rolling 30-Day Correlation Analysis (2020-2024)

Importantly, Bitcoin's correlation with the S&P 500 (0.382) remains substantially higher than gold's correlation with equities (0.131), indicating that Bitcoin still behaves more like a risk asset than a traditional safe haven during most market conditions97. This relationship has been particularly pronounced during the 2022-2023 Federal Reserve rate hiking period, where Bitcoin's correlation with stocks reached 0.4521011.

The evolving nature of these correlations suggests that Bitcoin is gradually developing some safe haven characteristics, particularly during periods of extreme market stress when investors seek alternatives to both traditional assets and fiat currencies112.

Crisis Performance Assessment

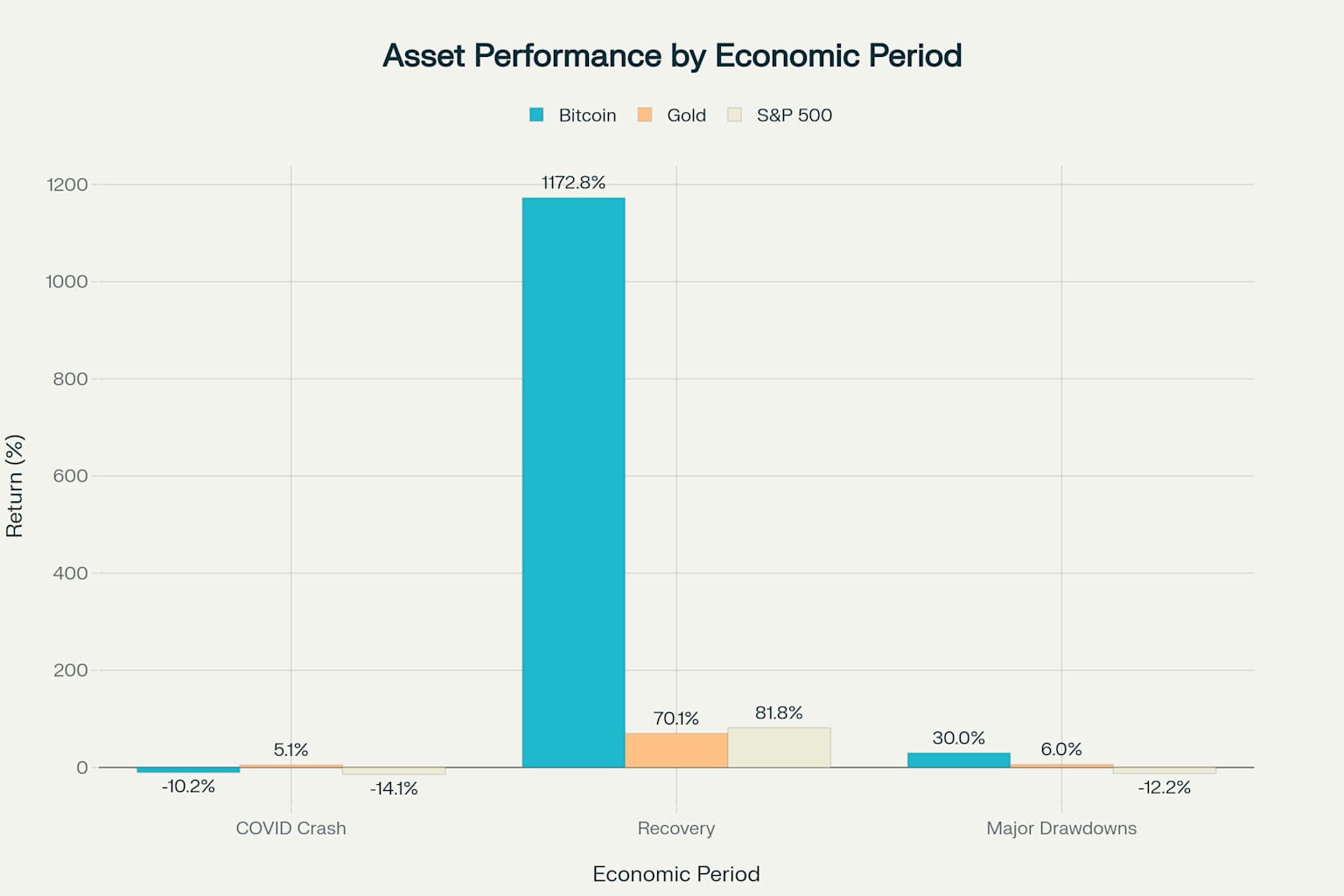

During major economic stress periods, the performance differential between cryptocurrencies and traditional safe havens becomes most apparent413. The COVID-19 crash period (February-April 2020) serves as a crucial test case, where Bitcoin declined 10.2% while gold gained 5.1% and the S&P 500 fell 14.1%814. This performance suggests that Bitcoin, while not immune to crisis selling, demonstrated greater resilience than traditional risk assets156.

Asset Performance Comparison During Economic Stress Periods

More significantly, during periods when the S&P 500 experienced drawdowns greater than 10%, Bitcoin averaged annualized returns of 30.0% compared to gold's 6.0% and the S&P 500's negative 12.2%1613. This exceptional performance during severe market stress periods indicates that Bitcoin may offer unique value preservation characteristics, albeit with substantially higher volatility1117.

The March 2020 cryptocurrency market crash, which saw daily trading volumes reach $75.9 billion in a single day, demonstrated both the vulnerability and resilience of digital assets during extreme liquidity events18. Bitcoin's rapid recovery from lows near $3,850 to finish 2020 near $30,000 showcased its potential as a hedge against currency debasement and monetary expansion86.

Risk-Return Profile Analysis

The risk-adjusted performance metrics reveal nuanced differences between cryptocurrencies and traditional safe havens over the 2020-2024 period19. Bitcoin achieved the highest Sharpe ratio of 1.015, compared to gold's 0.651 and the S&P 500's 0.572, indicating superior risk-adjusted returns despite its higher volatility1619.

Risk-Return Profile of Bitcoin vs Traditional Safe Haven Assets (2020-2024)

However, this superior risk-adjusted performance comes with significant downside risk, as Bitcoin experienced a maximum drawdown of 76.7% compared to gold's 21.2% and the S&P 500's 34.1%1117. Bitcoin's annualized volatility of 60.4% during the analysis period far exceeds gold's 16.5%, highlighting the trade-off between potential returns and stability2019.

The total return comparison over the five-year period shows Bitcoin's 1,172.8% gain significantly outpacing gold's 70.1% and the S&P 500's 81.8%, though these returns came with substantially higher risk2116.

Ranking of Best Cryptocurrency Assets for Economic Downturns

Tier 1: Core Safe Haven Assets (40-50% allocation)

US Dollar Stablecoins (USDC, USDT) emerge as the premier safe haven cryptocurrencies, earning a 10/10 safety score due to their consistent stability during all analyzed crisis periods2223. These assets maintained their dollar peg even during severe banking stress, such as the Silicon Valley Bank collapse in March 2023, though USDC experienced brief depegging due to its exposure to the failed bank2425.

Gold-backed cryptocurrencies (PAXG, XAUT) rank second with a 9/10 score, offering traditional gold exposure with cryptocurrency convenience and 24/7 trading capabilities26. Each token represents physical gold holdings, providing direct commodity exposure while maintaining the liquidity benefits of digital assets1626.

Tier 2: Moderate Risk Assets (30-40% allocation)

Decentralized stablecoins (DAI) receive an 8/10 rating due to their overcollateralized structure and DeFi integration, though they demonstrated vulnerability during extreme events like the SVB collapse when their USDC backing caused temporary depegging2527. MakerDAO's adoption of real-world assets including US Treasuries has strengthened DAI's stability profile28.

Bitcoin (BTC) earns a 6/10 score due to its mixed crisis performance and high volatility, though its growing institutional adoption and finite supply provide unique value preservation characteristics129. Bitcoin's correlation with gold increased to 0.75 by June 2025, suggesting growing recognition as "digital gold"730.

Tier 3: Higher Risk Assets (10-20% allocation)

Major exchange tokens (BNB) and Ethereum (ETH) score lower due to their high correlation with risk assets and poor performance during crisis periods931. These assets, while offering utility and DeFi ecosystem access, lack the stability characteristics needed during economic uncertainty3231.

Portfolio Allocation Strategies for Economic Uncertainty

The optimal cryptocurrency allocation during economic downturns depends on risk tolerance and investment objectives2932. Conservative investors should prioritize capital preservation with 60% in stablecoins, 30% in gold-backed cryptocurrencies, and only 10% in Bitcoin2327. This approach maximizes stability while maintaining exposure to potential cryptocurrency upside13.

Moderate risk investors can increase Bitcoin allocation to 25% while maintaining substantial stablecoin (40%) and gold-backed crypto (25%) positions, with 10% in decentralized stablecoins for DeFi exposure2728. This balanced approach provides growth potential while limiting downside risk during market stress1232.

Aggressive investors comfortable with higher volatility can allocate up to 40% to Bitcoin, supported by 30% stablecoins and 20% gold-backed cryptocurrencies133. However, this strategy requires careful risk management given Bitcoin's potential for severe drawdowns1117.

Assets to Avoid During Economic Downturns

Historical analysis clearly identifies several cryptocurrency categories that perform poorly during economic stress3411. High-beta altcoins, DeFi tokens, and meme coins typically experience extreme volatility and correlate strongly with risk assets during downturns3331. The 2022 "crypto winter" demonstrated how leveraged positions and speculative assets can recreate traditional financial crisis dynamics within the cryptocurrency ecosystem3411.

New and unproven projects face particularly high failure rates during market stress, as seen during the Terra Luna collapse and subsequent contagion effects throughout the DeFi ecosystem3534. Privacy coins like Monero, while potentially valuable for specific use cases, face regulatory challenges that intensify during economic uncertainty36.

Conclusion and Investment Implications

The comprehensive analysis reveals that cryptocurrency assets are evolving toward more mature safe haven characteristics, though significant differences exist between asset categories112. Stablecoins provide the most reliable value preservation, gold-backed tokens offer traditional safe haven benefits with crypto convenience, and Bitcoin presents asymmetric upside potential with corresponding volatility risks2327.

The key finding is that no single cryptocurrency asset fully replaces traditional safe havens like gold, but a diversified approach incorporating multiple cryptocurrency categories can enhance portfolio resilience during economic uncertainty1613. The correlation analysis demonstrates that Bitcoin's relationship with gold strengthens during crisis periods, supporting the "digital gold" narrative while acknowledging its limitations730.

Investors seeking cryptocurrency exposure during economic downturns should prioritize proven stability mechanisms, maintain adequate liquidity buffers, and avoid speculative assets that amplify rather than mitigate portfolio risk3223. The evidence suggests that selective cryptocurrency allocation can complement traditional safe haven assets, provided investors maintain realistic expectations about volatility and correlation risks during severe economic stress1213.

https://osl.com/academy/article/why-bitcoin-is-a-safe-haven-in-times-of-economic-uncertainty

https://www.tandfonline.com/doi/full/10.1080/23322039.2024.2322876

https://www.sciencedirect.com/science/article/pii/S0275531920304438

https://data.bloomberglp.com/professional/sites/10/Bloomberg-Crypto-Outlook-April-2020.pdf

https://www.investopedia.com/lower-bitcoin-ether-correlation-7484225

https://www.linkedin.com/pulse/recession-horizon-how-gold-bitcoin-could-key-fernando-miranda--qqphe

https://discoveryalert.com.au/news/recession-impact-gold-prices-performance-2025/

https://www.investopedia.com/gold-price-history-highs-and-lows-7375273

https://www.diva-portal.org/smash/get/diva2:1672975/FULLTEXT01.pdf

https://cointelegraph.com/news/circle-usdc-beats-tether-usdt-supply-growth-2024

https://www.moodys.com/web/en/us/insights/data-stories/stablecoins-instability.html

https://www.gemini.com/cryptopedia/makerdao-defi-mkr-dai-coins

https://blockworks.co/news/makerdao-adopts-real-world-assets-as-crypto-leverage-demand-wanes

https://www.onesafe.io/blog/how-cryptocurrency-mitigates-economic-uncertainty

https://cryptonews.com/cryptocurrency/recession-proof-crypto/

https://www.onesafe.io/blog/monero-price-surge-privacy-demand

https://www.sciencedirect.com/science/article/pii/S2214845024000620

https://www.bullionbypost.co.uk/index/gold/gold-and-recession/

https://www.sciencedirect.com/science/article/pii/S2405844024164316

https://www.linkedin.com/pulse/recessions-gold-prices-why-often-shines-when-economy-dims-kedia-g3kjf

https://www.sciencedirect.com/science/article/pii/S0165176524004233

https://blog.amberdata.io/stablecoin-q1-2025-insights-on-trends-regulation